Update: This article was last updated on 22nd December 2023 to reflect the accuracy and up-to-date information on the page.

Successful people understand their finances very well!

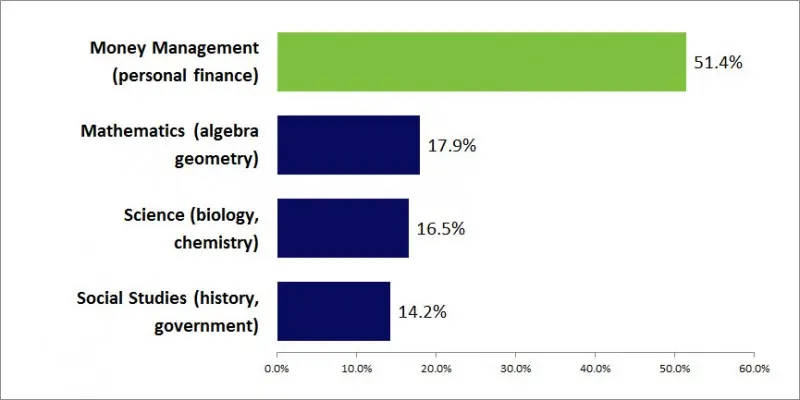

Financial literacy is not a commonly found skill among children. Until the late 2000s, financial literacy wasn’t a part of the school curriculum. Even today, only a handful of schools have recognized the significance of teaching money management skills and added it to their curriculum.

Perhaps it’s only a matter of time before financial literacy becomes an integral part of every student’s life, thanks to free e-learning platforms like Youtube and Udemy, where you can find hundreds of finance educators sharing insights on money management. Their content is diverse and caters to the needs of almost all age groups.

According to Emplifi’s social insights, finance creators produce more than 5x as many videos on YouTube and nearly gain double the number of subscribers compared to other influencers on the platform.

In addition to this, on March 2023, Udemy has about 10,000 courses on Money Management Skills for both adults and students. The message is clear, getting acquainted with financial literacy is the need of the hour. The earlier children learn about financial management, the better equipped they will be to build a successful life.

Financial Education by Age Group

| Age Group | Saving | Spending | Earning |

|---|---|---|---|

| 3 to 5 Years | Get a piggy bank. Bills in see-through containers. | Take them shopping. Choose treats and pay occasionally. | Dole out the dough. Tasks like lining up shoes or recycling. |

| 6 to 8 Years | Give 'em a goal. Use charts to visualize savings. | Watch ads together. Teach about advertising tricks. | Look for bigger jobs. Discuss paid chores like bagging leaves. |

| 9 and up | Start budgeting. Weekly lunch budget and decisions. | Be kind (and flexible). Talk through spending decisions. | Encourage entrepreneurship. Propose fixes for needs or start small projects. |

| Young Adults | Put 10% in long-term savings. An emergency fund for uncertainties. | Be mindful of choices. Talk about needs vs. wants. | Entrepreneurship continued. Lemonade stand or yard sale with supervision. |

6 Reasons To Introduce Money Management Skills In Your Child’s Life

1. Develop responsible spending habits

Do you often find your kids demanding new toys, gadgets, or other items without taking into consideration the price tag of the product? Giving them a weekly budget or allowance can help.

Starting as early as five years old, you can give your children a small amount of money each week that they can use to buy things they want. By doing so, you can teach them the value of money and how to make informed decisions about how to spend it.Encourage your children to think carefully about their purchases. This will not only help them prioritize their wants and needs but also make them responsible spenders as adults, avoiding debt and financial pitfalls.

2. Encourage goal-setting

Regardless of the amount of money, we make as adults, each one of us has certain goals in mind that we yearn to accomplish through financial gains. Setting goals and working towards them is a big part of learning money management. It teaches children the value of setting their personal financial goals. They learn that saving for a specific item or activity takes time and effort and that achieving their goals is satisfying.

By helping your kids set and achieve financial goals, you can teach them valuable lessons that go beyond just managing their finances. In the process, they can also learn about delayed gratification, the importance of saving, and the rewards of hard work that can set them up for a lifetime of financial success and independence.

3. Foster independence

The first step to fostering financial independence in kids is to trust them with their allowance money. The second step is to open a bank account. The whole idea behind teaching them money management revolves around giving them the tools and knowledge they need to manage their finances. These small but significant steps will not only help them develop the required skills to manage their money wisely but also boost the confidence they need to become financially independent as they grow older.

4 Get Them Started with Investing

Once your children have saved some money, you may wish to introduce them to investments. You could, for example, open a second account or buy a piece of stock. This helps them feel like they own a piece of a company and teaches them about handling their money.

Remember that there are specific tax restrictions for such accounts, so explain this to them. You can do it yourself or hire a subject matter expert to do it for you.

5. Prepare for the future

Preparing for the future is an important aspect of financial management, and it is essential to teach children how to navigate complex economic scenarios. With the current state of the economy, it’s more important than ever to help children learn the skills they need to be financially stable in the future.

One way to do this is by teaching kids the basics of saving and investing. These habits will help them build a nest egg they can rely on during tough times. Understanding the concepts like credit and debit, interest rates, and inflation rates can help them better evaluate their purchases or the need for non-essential purchases. This will help them survive and thrive in an ever-changing economic landscape.

6. Build confidence

The skill to manage money will boost children’s confidence in their ability to make smart financial decisions. They will learn how to evaluate the cost and value of different purchases, and they will develop a better understanding of how money works in the world.

It can have a positive impact on other areas of their lives. They will become more independent and self-reliant, and they will be better prepared to face the challenges and opportunities that come their way.Overall, it develops important life skills in children, like goal-setting, problem-solving, and critical thinking, essential for success in many areas of life.

Tips For Money Management Skills For Children

- Save with a Piggy Bank: Use a piggy bank and clear containers to show kids how to save money.

- Have Savings Goals: Make saving fun by setting goals, and use charts or pictures to help kids see what they’re saving for.

- Decide on Spending: Involve children in spending decisions. Talk about what they need versus what they want and be understanding.

- Learn to Budget: Teach basic budgeting as kids grow. Give them a weekly lunch budget and involve them in making choices.

- Try Entrepreneurship: Encourage a business mindset by suggesting small projects or activities, like a lemonade stand or a supervised yard sale.

Conclusion

The benefits of learning financial management cannot be overstated. It can help your child develop important life skills and prepare them for a financially secure future. Remember, financial education is an ongoing process. Investing in children’s financial education is one of the best things you can do for their future, and it will pay dividends for years to come.

Moonpreneur is dedicated to transforming conventional education, preparing the next generation with comprehensive learning experiences. Our Innovator Program equips students with vital skills in AI/ML, Robotics, Coding, Game Development, and App Development, fostering entrepreneurship through hands-on learning. This initiative aims to cultivate the workforce of tomorrow by integrating innovative technologies and practical skills in school curriculums.

Register for a 60-minute free workshop today!

Will money management education help my kids grow up to be more responsible adults?

Early financial education is linked to responsible financial behavior throughout adulthood, according to numerous research studies.

Do financial education programs have any lasting advantages for kids?

Yes, kids with better financial literacy tend to make better decisions, stay out of debt, and have a more secure financial future.

I always feel that financial literacy is limited to children from wealthy homes, is it so?

No, it’s important for everyone to be financially literate. Educating kids about money can help close the income gap by giving them the skills they need, no matter where they come from.

Is it right for kids to be worrying about money at such a young age?

Money management education isn’t about making you feel anxious, it’s about helping kids learn how to manage their money in a healthy way. Early learning helps kids learn how to think about money in a positive way.

In what way may nonfinancial parents impart financial knowledge to their kids?

Use appropriate educational materials, books, and online resources, and engage children in family conversations on budgeting and financial matters to provide them with practical information.