Moonpreneur

Money management is a critical life skill that can impact an individual’s future success and financial stability.

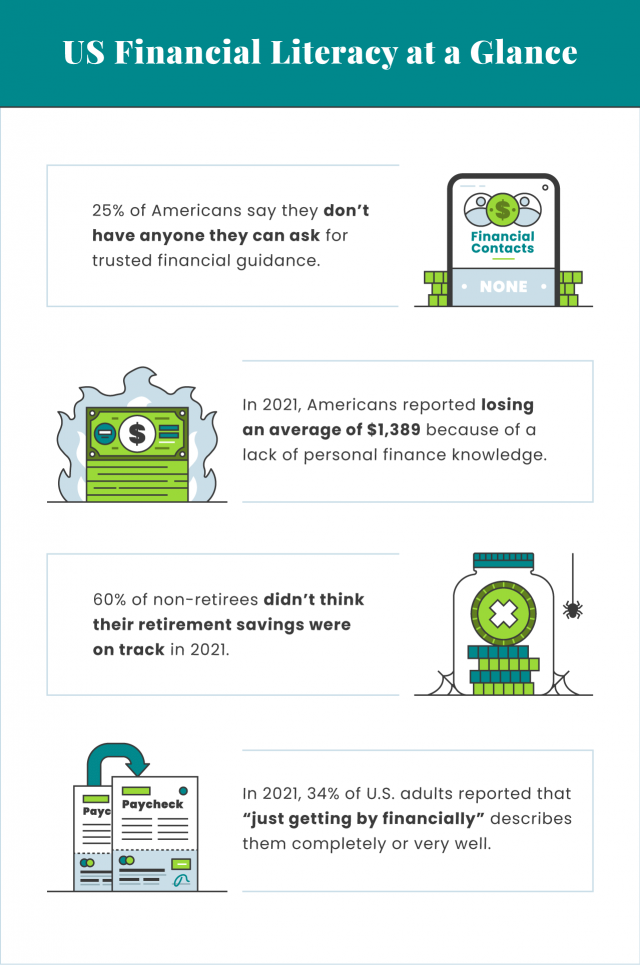

Shockingly, recent studies have shown that 75% of American teenagers lack confidence in their understanding of personal finance, and 23% of young adults have overdue credit card debt. Furthermore, the total credit card debt in the US has surpassed $800 billion, indicating a lack of financial literacy among adults.

According to the report, 41% of teenagers have no idea what a 401(k) – an employer-sponsored retirement plan – is, and 32% have no idea what the difference between a credit card and a debit card is.

The data demonstrate many youngsters’ lack of understanding of basic financial words and concepts.

Importance of financial literacy to child

Children develop a sense of wants and need early on but may forget the importance of saving and investing for a secure future. Parents can help children develop the necessary skills to make informed financial decisions, avoid common financial mistakes, and manage their money effectively by teaching them about budgeting, saving, and investing.

Financial literacy, a crucial life skill that children should learn early on, can also instill a sense of responsibility and independence, helping them develop good habits that will benefit them throughout their lives.

Recommended Reading: The Best Children’s Financial Literacy Apps

As parents, it’s essential to ensure that our children are well-equipped to handle finances in the future. In this blog post, we’ll provide practical tips and strategies to teach financial literacy to your child, setting them up for financial independence and success.

Effective Methods to teach financial literacy

1. Explain the difference between needs and wants

Making the child understand the difference between wants and needs is vital in teaching financial literacy. Needs are things that we cannot live without, such as water, food, shelter, and clothing.

Conversely, wants are designer clothes, expensive shoes, the latest gadgets, and luxury cars. After sharing examples, parents can ask their children to list their possessions and categorize them as needs or wants.

Teaching children to differentiate between their needs and wants can help them develop strong financial literacy skills, making them better equipped to manage their money effectively.

2. Give pocket money to a child and let them save

Introduce the savings concept at a young age because it is the cornerstone for a strong financial foundation. Consider giving monthly pocket money and asking them to spend wisely and save for future purchases.

Pocket money is one of the most basic ways to teach financial literacy; from spending responsibly to saving and investing for the future, children may practice various financial habits. In the long run, it will teach them to spend on assets rather than obligations.

As children closely follow their parents, their behavior is the most significant source of learning for them. So, set a good example for your child regarding savings goals and financial management.

3. Have a review session

Encourage your child to record their spending in a diary, reminding them to record every expense and to balance their entries regularly. Set a weekly review meeting at the dining table, and review their financial records. This will help your child understand their spending habits and identify areas where they can improve their financial management.

Furthermore, explain how excessive spending affects the monthly budget. When your child is too young, explain the arithmetic behind the budget computation. If you want your child to be the finest financial manager, remember to execute this chore regularly.

4. Ask children to prepare goals

Asking children to save money is not enough. They should set a goal (for instance: buying an expensive toy) and save money. When a child saves money and buys something they desire, it brings inner satisfaction and happiness.

Apart from pocket money, reward children every time they accomplish a goal or task. This will motivate them, and they will continue the process until they reach their objective.

5. Take kids grocery shopping

Another way of providing financial literacy to children is taking them grocery shopping with you. It has long-term benefits. Before heading out shopping, involve your child in preparing a shopping list to ensure they understand what is needed and avoid overspending. This activity can help them focus on the necessary items and avoid impulse buying, ultimately leading to more efficient use of money.

Encourage your child to create a shopping list, which can help them understand the value of planning and budgeting. Involve them in calculating expenses while shopping by having them add up the cost of items on their list and solving quick math problems related to money. Practicing these skills regularly can improve their ability to calculate and manage money, contributing to their financial literacy.

6. Utilize every opportunity

Avoid giving in to your children’s desires and impulses while shopping, and instead, have conversations about purchases with them, helping them consider all important factors before making a decision. Encourage them to apply the lessons they learn from grocery shopping to other purchases.

Teach them to save money by waiting for sales and looking for discounts, and show them how to use a debit card and conceal the pin. Additionally, encourage them to compare items by reading labels and selecting purchases that fit their budget.

7. Play strategic games

Introducing your child to board games such as Game of Life, Monopoly, Stock Exchange, Moonpreneur Board Game, Business, and Payday can be an effective way to teach financial literacy. These strategy games can help children learn concepts such as investing in stocks, saving money in a bank, and keeping contingency funds.

Play these games with your children to help them develop a positive attitude toward money and become aware of important financial concepts.

Bottom line

Parents may initially find it challenging to get their children interested in financial literacy, but it’s essential to be persistent and make the process enjoyable and engaging.

Use these tips to help your child develop financial literacy skills. Children who learn financial management at a young age are more likely to succeed in the future and avoid financial crises in any situation.

Moonpreneur is dedicated to transforming conventional education, preparing the next generation with comprehensive learning experiences. Our Innovator Program equips students with vital skills in AI/ML, Robotics, Coding, Game Development, and App Development, fostering entrepreneurship through hands-on learning. This initiative aims to cultivate the workforce of tomorrow by integrating innovative technologies and practical skills in school curriculums.

Register for a 60-minute free workshop today!