Moonpreneur

Kids today are fast learners, and as responsible parents, we must ensure that our kids learn about finance from a young age. The current scenario of financial literacy paints a grim picture, and out of many important life lessons that we can teach them, one of the most important ones is learning how to achieve financial literacy and freedom.

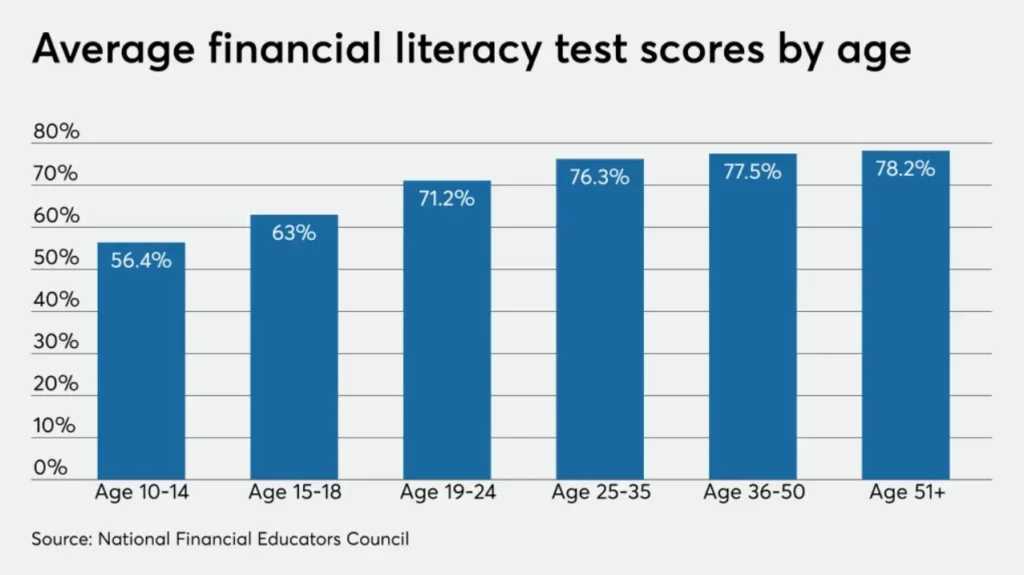

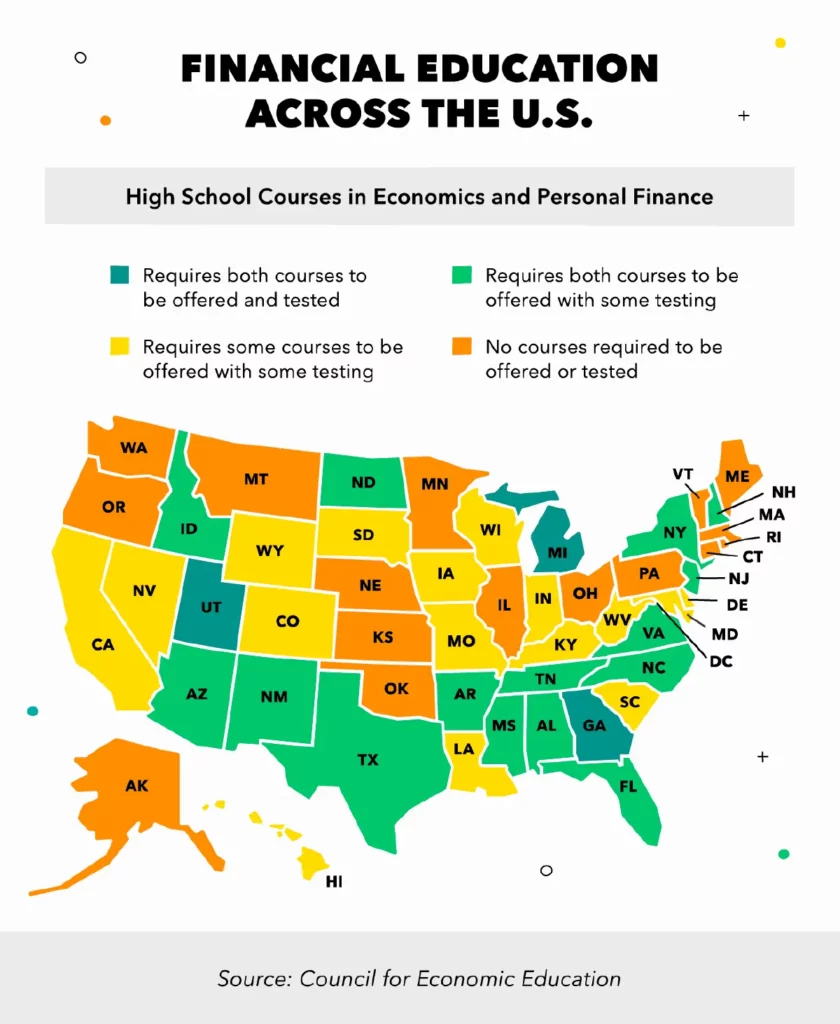

According to a survey conducted in the US among the age group of 15-year-old kids found that close to 18% of them lacked fundamental knowledge about finance, which are useful in day-to-day activities such as budget planning, understanding invoice, etc. Another survey done in American high schools revealed only 48% of students showed a correct understanding of personal finance, making it a crucial topic to be taught to the youth.

Post viewing the above stats, teaching personal finance to kids in their initial years is important as it helps kids grow into financially responsible citizens. In this blog, we shall explore what you should know while teaching your kids personal finance.

Recommended Reading: 10 Ways How To Raise a Problem-Solver Kid and Teach Problem-Solving Skills

1. Start Early

It’s never too early for kids to start learning about personal finance. Even children as young as 4 years of age can start learning about basic concepts like saving and spending money. As they age, they can be introduced to more advanced topics like budgeting, investing, and credit. An early start would help them develop responsible money-handling habits, thus helping them avoid common financial pitfalls.

2. Make Finance Fun

Let’s face it; finance can be pretty boring if not taught in a fun way. To help make it fun and interesting, we recommend using board games such as Moonpreneur, Monopoly, Game of Life, Business, and Payday which are not only fun to play but also teach life and finance lessons. These board games are well suited for teaching kids money management, planning, saving, etc.

3. Teach Them The Art Of Saving

Learning how to save is one of the most important aspects of personal finance. It’s essential to teach your kids how to save money early on so that they can develop the habit of saving. Encourage them to save a portion of any money they receive, whether from an allowance, birthday gift, or other sources. You can also match their savings to incentivize them further.

Recommended Reading:

4. Help Them Set Achievable Goals

Teaching kids how to set achievable financial goals is crucial to help them gain financial success. Help your kids set both short-term and long-term goals. Several banks today offer an option of a child-friendly bank account with zero minimum balance requirement. Enroll your kid in one of these and try setting short-term and long-term saving goals for them. Encourage them to track their progress towards their goals and celebrate when they reach them.

5. Teach Them How To Make A Budget

Making a budget is an essential skill that will help your kids throughout their lives. In order to teach them how to create a budget and stick to it, involve them while you are making a budget for your household and let them know how a monthly budget is made and savings are set aside in order to ensure all necessities are met. Now, you can encourage them to set aside money for savings from their allowances for their financial goals before spending on discretionary items.

6. An Introduction To Investing

Learning investing methods may be difficult for young children, but it’s never too early to start teaching about it. As your kids get older, slowly introduce them to the basics of investing. Start small, and teach them what stocks and the stock market are, how bonds work, and why one saves in mutual funds. An understanding of the risks and rewards of investing will help them in starting their investments young and with appropriate knowledge.

7. Teach Them About Credit

Credit is an important part of personal finance, and your kids need to know about it. As they grow and approach their teens, every parent must explain to their kids what credit is and how it works. Teaching them about interest rates and how to avoid getting burdened by heavy debt in their lives. This would naturally encourage them to build good credit by paying bills on time and using credit responsibly as they grow up.

8. Be a Good Role Model

Finally, it’s essential to be a good role model when it comes to personal finance. Kids learn by example, so make sure you’re practicing good financial habits yourself. Be honest about your financial mistakes and what you’ve learned from them. Remember to be a good role model and practice what you preach.

To summarize, personal finance is a critical skill that can help your kids succeed. An early start will help your kids ace even the complex finance-related things such as investments and the stock market in their future as well as help them in building healthy finance habits, which will, in turn, secure their future.

Moonpreneur is on a mission to disrupt traditional education and future-proof the next generation with holistic learning solutions. Its Innovator Program is building tomorrow’s workforce by training students in AI/ML, Robotics, Coding, IoT, and Apps, enabling entrepreneurship through experiential learning.

Bankers Savings Account taught my son to master the art of saving and establish good financial habits while they earn rewards.

You must add a 50-30-20 rule in your blog which recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.