Moonpreneur

Teaching kids the fundamentals of inflation and recession can become a tricky affair. Although, in the present ongoing state of affairs imparting knowledge regarding these complex subjects will help them understand and analyze the market better.

Inflation and recession are important economic concepts, and we’ll try to decode these terms in this blog.

What Do You Mean By Inflation?

Let’s learn about inflation first. Inflation is the rate at which the general price level of goods and services in an economy increases over time. If explained in simpler terms, commodities are getting more expensive.

Allow me to explain to you through an example. Imagine that you have a bag of candy with 10 pieces in it. You know that you can buy a toy you want for 10 pieces of candy.

But then, one day, you find out that the store raised the price of the toy to 20 pieces of candy! Suddenly, you don’t have enough candy to buy the toy anymore. This is kind of like what happens during inflation.

Inflation is when the prices of things go up over time, so the same amount of money can buy you less and less. Just like how your 10 pieces of candy used to be enough to buy the toy you wanted, but now you need 20 pieces of candy.

In the real world, this happens with money. The prices of things like food, clothes, and toys go up, so you need more money to buy the same things you used to be able to afford. Many factors can cause inflation, such as an increase in demand for goods and services, an increase in the cost of raw materials, or an increase in the money supply in the economy.

How does inflation affect our lives?

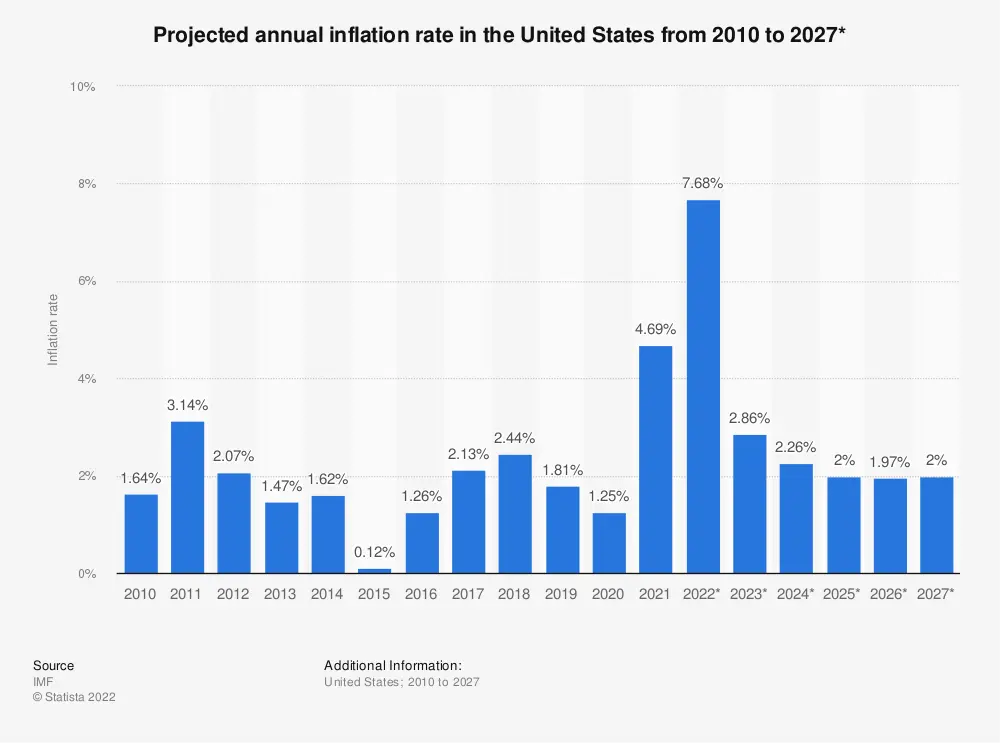

Inflation can affect our lives in many ways. According to reports, the annual inflation rate in the United States has spiked from 3.2% in 2011 to 8.3% in 2022. This spike has affected the cost of living of thousands of people across the country.

The same goods and services that you used to purchase before at a lower price now cost more as prices go up. This implies that we may need to spend more to maintain our standard of living because our money doesn’t travel as far as it once did.

The same goods and services that you used to purchase before at a lower price now cost more as prices go up. This implies that we may need to spend more to maintain our standard of living because our money doesn’t travel as far as it once did.

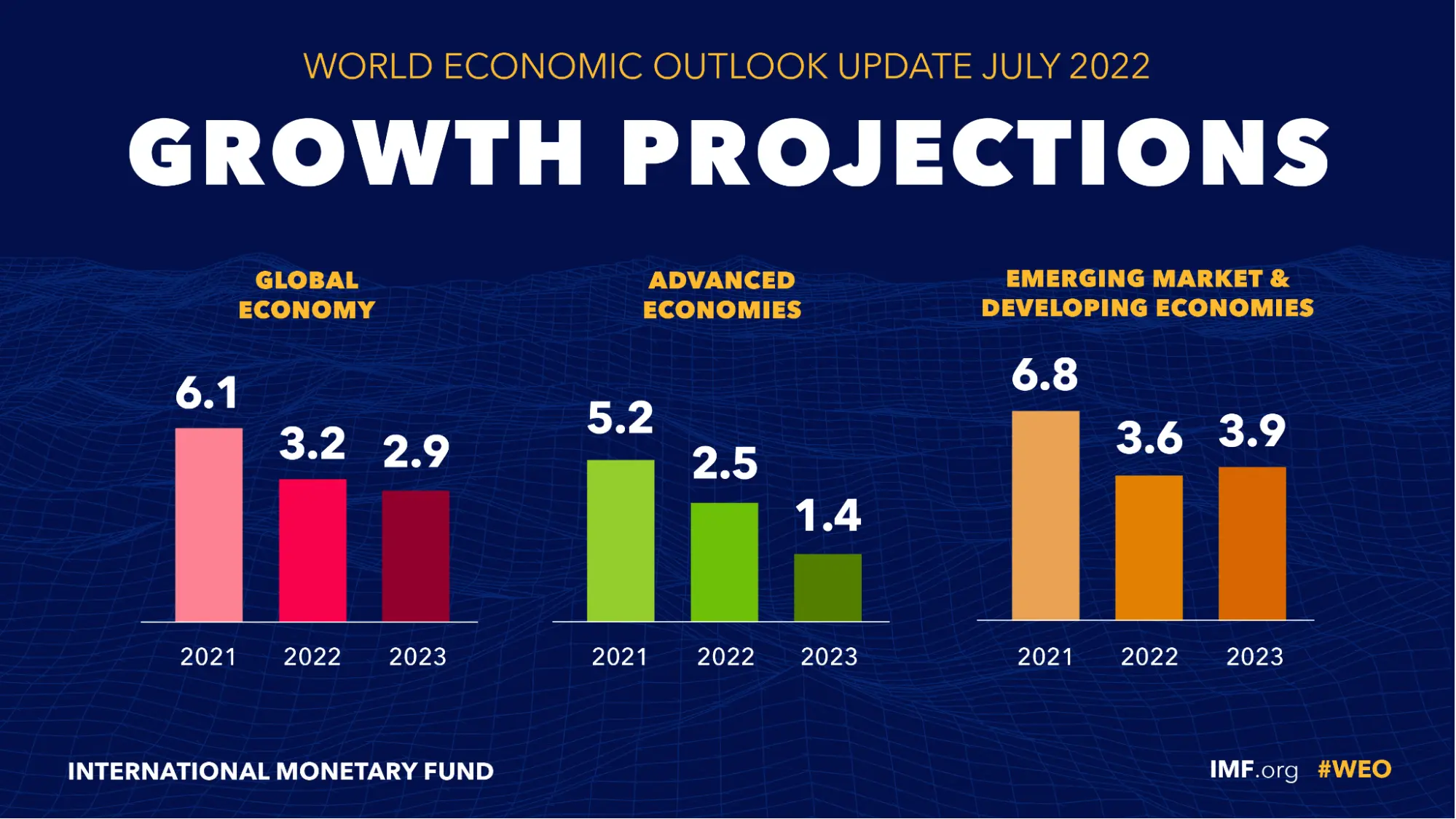

Inflation is known to have an impact on the entire economy of a nation. Consumer spending may decline as a result of high inflation, which has the potential to become a roadblock in the nation’s economic growth.

What Do You Mean By Recession?

Recessions are times when the economy is not expanding but rather contracting.

Simply put, it indicates that the economy is shrinking. Many businesses may struggle to profit during a recession, which could result in job losses and lower consumer spending.

Several things, like a drop in consumer spending, a fall in company investment, or an increase in borrowing rates, can contribute to recessions.

Let’s understand this with a practical example:

Imagine that you and your friends sell lemonade on a hot summer day. You usually sell a lot of lemonade and make a good profit. But one day, it starts raining and no one wants to buy lemonade. You must close your lemonade stand early because you’re not making enough money. This is like a recession because the rainy weather affected your sales, and you couldn’t make as much money as you usually do.

How does a recession affect our lives?

If an economy experiences a recession, it can have several effects on our daily lives. Job cuts are one of the outcomes of a recession. Layoffs may become the only way out for businesses having trouble making a profit to reduce costs. This results in high unemployment rates, making it challenging for people to survive.

People’s investments and money suffers during a recession. The value of our investments may diminish if the nation’s stock market takes a severe hit during a recession period. This implies that in order to reach our financial objectives, we might need to save or invest more money.

Ultimately, a recession can have an impact on the entire economy. Consumer confidence and spending may fall when the economy is not expanding, which may further hinder economic growth. A recession may, in rare instances, turn into a depression, which may be exceedingly challenging for both people and businesses.

| Characteristics | Inflation | Recession |

|---|---|---|

| Definition | The rise in the prices of goods and services in an economy is referred to as inflation. | A recession is a time when the economy slows down and there is negative growth. |

| Measure | CPI (Consumer Price Index) and WPI (Wholesale Price Index) are two indices that are used to calculate inflation. | A decrease in a nation's Gross Domestic Product, or GDP, is calculated to evaluate recession. |

| Period | Inflation occurs on an ongoing basis in the economy. | A recession occurs due to the presence of certain economic conditions. |

Moonpreneur is on a mission to disrupt traditional education and future-proof the next generation with holistic learning solutions. Its Innovator Program is building tomorrow’s workforce by training students in AI/ML, Robotics, Coding, IoT, and Apps, enabling entrepreneurship through experiential learning.

Does inflation cause recession?

Inflation can cause a recession in some instances like if inflation spurs consumers to cut spending too much.

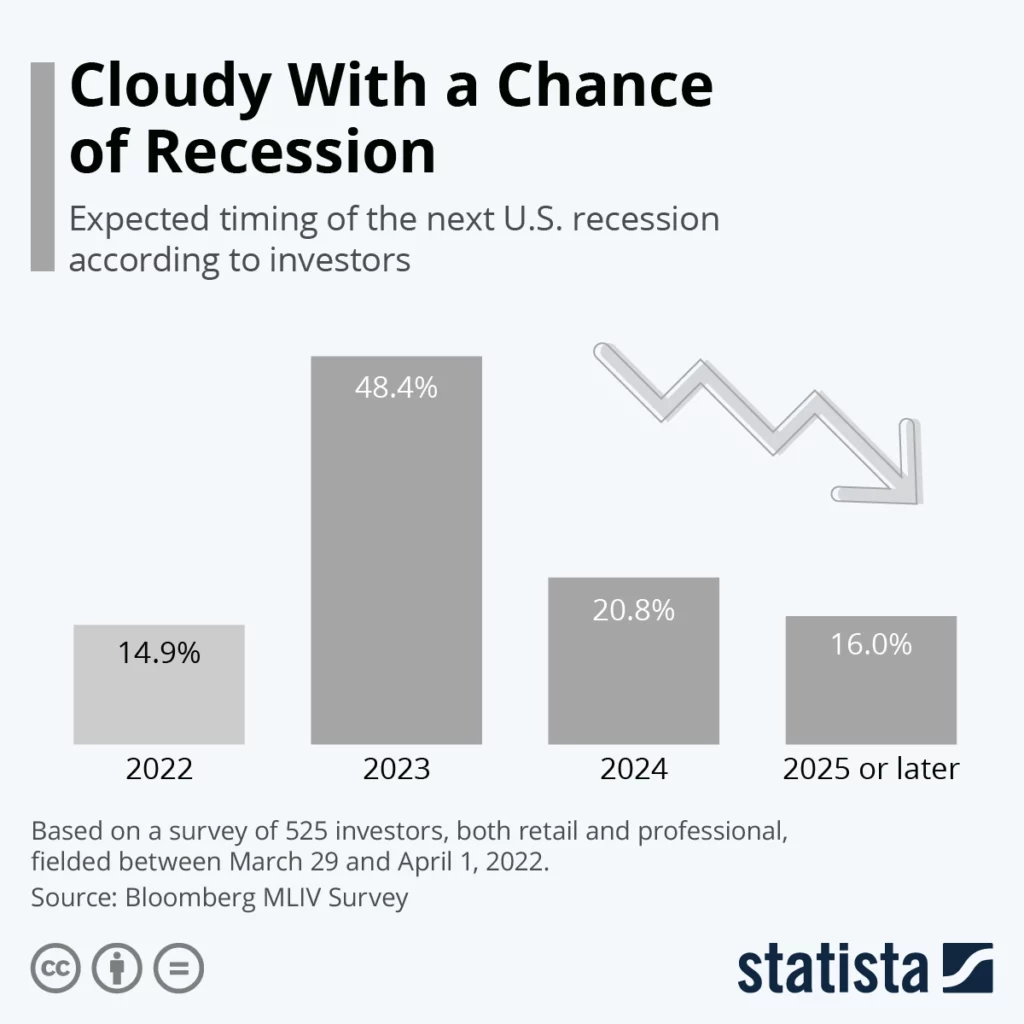

Experts now say a soft landing or mild recession is possible in 2024