Update: This article was last updated on 20th January 2026 to reflect the accuracy and up-to-date information on the page.

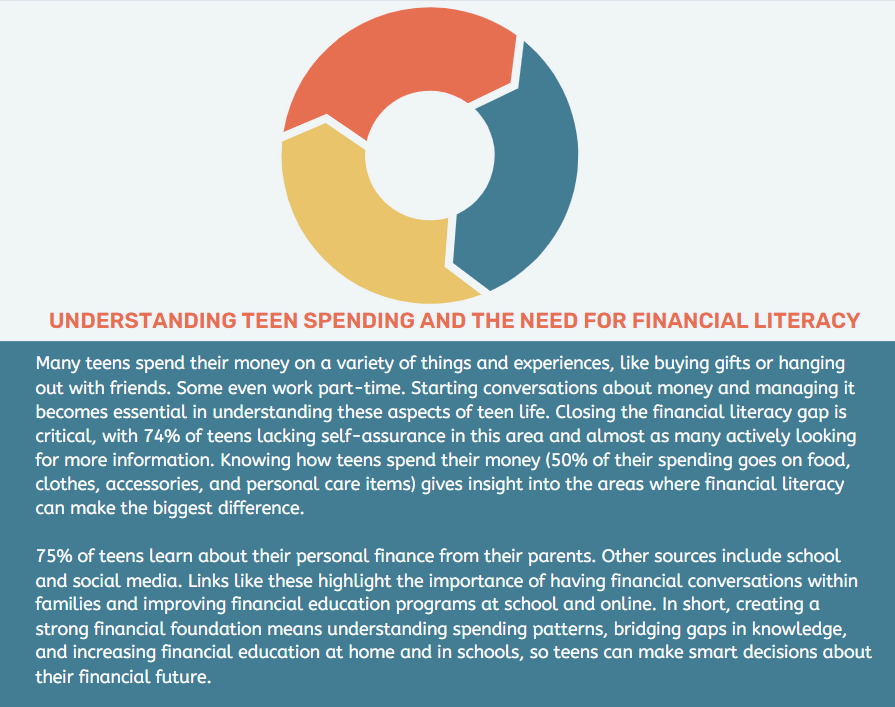

Believe it or not, teens want to stay in the know for everything. They are way more intelligent than we think, and with evolving days, their concept of money isn’t just limited to asking for more allowance from their parents. The teenage years are pretty likely that phase where one hardly realizes the toil of earning money. Hence, learning money management is essential. You will only bask in the glory to find yourself channeling and making the best use of every penny in the future, right from the very first day of receiving your paycheck.

References: statista.com

Money management or financial planning takes into its grip every bit related to budgeting, saving, and spending wisely. Other things that are of equal importance are decision-making, valuing time, maintaining records, and balancing expenditures. It is always good to start early so that there’s no regret later. Here are a few financial planning tips for the teens.

1) Be Conscious of Time:

Yes, it’s one of the most precious aspects, and one better be wise enough to make the best use of it. Being a teen obviously means you aren’t doing a full-time job. But you may be doing several stop-gaps during those seasonal offs from the academic schedules. Whatever you might be bagging, start saving right away, even if it’s a micro. Now, the most crucial part is that you have to keep that untouched, whatever it takes, for quite some years. A Roth IRA is one of the best options if you wish to lock your money for a long time. Investment in a Roth IRA is tax-free if you withdraw it after 59.5 years of age. So, you see how important it is to conceive the value of time.

2) Turn on the Money-saving Mode

Well, what do you call a habit? Getting up at a fixed time in the morning? Brushing my teeth twice a day? Taking a bath every day? Checking your mobile phone now and then? (sure it is!) A natural act that you are inclined to perform over and over becomes your habit. Teens prefer wearing fancy outfits, eating out, visiting clubs, and partying to the brim. And, of course, all these make for a lot of spending. How about keeping a check on these and turning on the money-saving mode? Be it a gift, an allowance from your parents, a job payment, or a stipend – it is just a good habit to save a portion of it – no matter the amount. Also, the teenage years are ideally the time when there’s hardly any responsibility or liability; hence, saving money at this stage is a wiser option. Trust us, the older you get, the harder it may become. How about saving half of the money you have in hand? Saving in a high-yield savings account is also a great option. Most often, these banks encourage savings, discourage withdrawals, and encourage the use of ATM cards. So your money will be right where it should be!

3) Keep an Eye on Spending

As a teen, one could be getting cash as a stipend or payment from temporary involvements. Here’s advice – bank them and, most importantly, separate the cash that’s meant for saving from the one that’s meant for spending. And yes, use plastic money for any transaction. It’s kind of a fact that the more a wallet is visibly loaded, the sooner you burn a hole in the pocket. Having said this, it is also essential to cut down on unnecessary spending.

Similar Read: Exploring Web Scraping In Python: Tools, Techniques, And Ethics

4) Inherit the Education

Just like no recipe can beat mom’s cookbook, similarly, no advice can be as worthy as that coming from the parents. It will be awful if a teen has to start a financial journey without the right piece of advice from the parents to ‘use the card responsibly.’ As a teen, you might unknowingly invite a lot of suggestions (of course free) from those who do not! Think before planning your finances if at all that advice can get you sailing smoothly. You might come across a lot of printed stuff to add to your knowledge. But, you know what? A personal touch from those two who know you top to toe can make the most difference. They are never going to thrust you into the mad race without sharing all the wisdom for good. Get the downloads about maintaining the records, checking the scores, budgeting the expenses, and whatnot. This tit-bit advice can be really beneficial.

5) It’s Never Too Early

6) Set Financial Goals

Advise teens to define their long-term and short-term goals clearly. Setting achievable goals is essential for a number of reasons, including paying for college, saving for an expensive item, and preparing for future investments. In this article, we’ll explore the ins and outs of goal-setting. We’ll look at how it works and how it can be used to create a comprehensive roadmap to financial success. When teens set specific goals, they’re motivated and have a clear sense of where they want to go. This allows them to develop disciplined financial planning strategies that go beyond wishful thinking.

Similar Read: Hidden Talents: Exploring Lesser-Known Skills That Can Give You an Edge.

7) Track and Review Expenses Regularly

To reinforce the idea of mindful spending, emphasize how important it is to track and evaluate your spending regularly. To stay on top of your finances, use helpful tools such as spreadsheets for budgeting apps. This provides teens with valuable advice on regularly reviewing their spending habits. It allows them to identify areas for improvement, allowing them to take a proactive approach to improving their overall financial well-being. Teens raised with a constant sense of financial awareness are more likely to make sound financial decisions.

8) Explore Financial Literacy Resources

Introduce young people to a wide range of trusted and diverse tools to help them expand their financial literacy. Whether it’s reading engaging books, taking online courses, or attending a financial literacy workshop, young people prepare for responsible financial decisions by gaining a deep understanding of concepts such as investment, compound interest, and fundamental economic principles. This equips young people with the skills they need to manage their financial education by emphasizing the importance of lifelong learning and providing concrete recommendations for easily accessible and trusted financial education materials.

9) Embrace the Power of Compounding

Explain what compounding is and why it’s essential to start saving early. Compounding is the process of increasing the amount of money you save over a certain period. Compounding interest is the process of adding money to your savings over some time until it accumulates a certain amount of money. Compounding interest increases the amount of money that accumulates over time because of the constant giving and receiving of money. Using real-life examples, kids understand the vast potential for growth that their savings can provide. Compounding acts as a catalyst, prompting teens to prioritize long-term planning over short-term gratification.

10) Learn from Mistakes

Realize that mistakes happen, especially when your teen is learning about money all the time. Please encourage them to look at their mistakes as valuable learning opportunities instead of failures. This article talks about resilience and encourages teens to use their mistakes as learning opportunities to change their approach to financial planning. Teens with a growth mindset are better prepared to handle financial planning. They learn from their mistakes and use them as a learning opportunity to build a more secure and informed financial future.

In short, careful financial planning in teens sets the stage for a secure and informed future. By following these financial planning tips, teens can navigate the complexities of money, make informed decisions, and create long-term financial stability.

Moonpreneur is on a mission to disrupt traditional education and future-proof the next generation with holistic learning solutions. Its Innovator Program is building tomorrow’s workforce by training students in AI/ML, Robotics, Coding, IoT, and Apps, enabling entrepreneurship through experiential learning.