Update: This article was last updated on 9th August 2024 to reflect the accuracy and up-to-date information on the page.

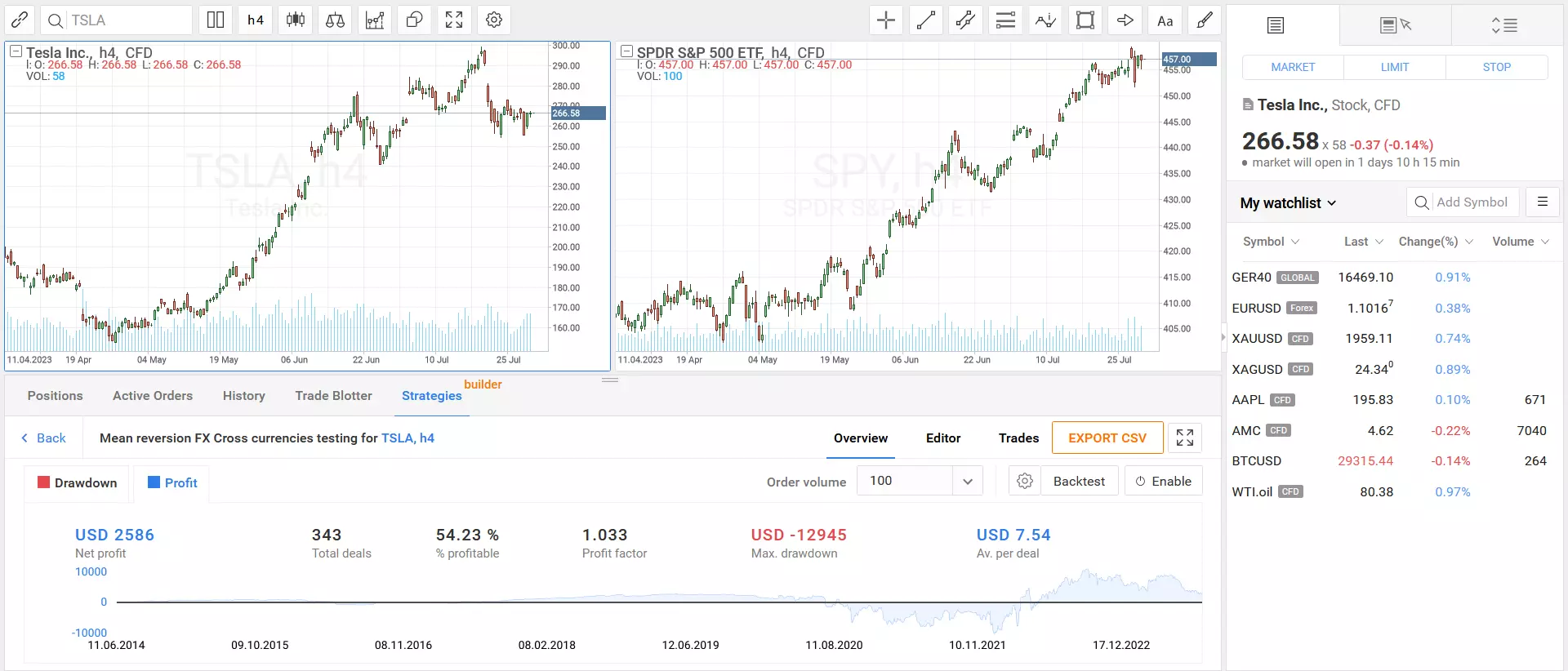

Forex trading robots are software programs designed to automatically generate trading signals. Many of these robots are constructed using MetaTrader and utilize the MQL scripting language. This enables traders to generate signals, place orders, and manage trades effectively.

Unveiling the top robots for trading forex can ease your journey in the market, whether you’re striving for profitability or just embarking.

These robots for trading forex employ intricate algorithms to pinpoint lucrative trades, offering the flexibility of automatic or manual trading within preset parameters. Successful trading mandates ongoing vigilance of currency market shifts, global economics, and news updates while capitalizing on historical data for strategic entries and exits.

By automating trading operations, these robots eliminate emotional biases, ensuring uninterrupted trade management and unlocking passive income prospects. Tailored to accommodate novices and seasoned traders alike, forex robots offer customizable features for various skill levels.

Below are some of the leading trading robots for trading forex we consider the finest in the industry for 2024. Designed for both novice and seasoned traders, they are readily accessible as instant downloads and compatible with most brokerage platforms.

1. IG – One of the Best Automated Forex Trading Robots

IG Forex Trading Robots, offered by IG Group, provide automated trading solutions for forex traders. IG Forex Trading Robots offer automated trading solutions integrated with the IG trading platform, providing users with access to diverse trading robots and market analysis tools. However, users should be aware of the limitations and potential costs associated with using automated trading robots, as well as the need to remain vigilant during periods of market volatility.

Pros

1. Seamless Integration: IG Forex Trading Robots integrate with the IG platform, enabling direct access to automated trading features within IG accounts.

2. Diverse Options: IG offers a range of forex robots catering to various trading styles, allowing users to select the most suitable one.

3. Backtesting: Users can assess robot performance through historical data, ensuring effectiveness before live deployment.

4. Market Analysis Tools: IG provides comprehensive market analysis resources to complement robot signals, aiding informed decisions.

5. Regulatory Compliance: IG Group’s regulation offers users security for funds and platform reliability.

Cons

1. Limited Customization: Users may face restricted customization options for robot trading strategies.

2. Cost Considerations: Additional costs like subscription fees or commissions may impact overall profitability.

3. Market Dependency: Robot performance is subject to market conditions, potentially leading to underperformance in volatile markets.

4. Technical Glitches: Users may encounter connectivity issues or glitches, disrupting trading and causing missed opportunities or losses.

5. Learning Curve: Understanding robot operation and effective utilization may require time and effort from users.

2. Forex Gump – One of the Best Forex Trading Robots with Demo Account

Forex Gump, renowned for its simplicity and effectiveness, is an automated trading robot gaining significant attention. Celebrated for reliability and user-friendly design, it offers traders a straightforward entry into forex markets. With strong profit potential, it attracts both novices and seasoned traders. However, users must be cautious of associated costs and market risks. Additionally, being mindful of potential technical glitches is crucial. Despite these considerations, Forex Gump remains a preferred choice for automated trading in the forex market.

Pros

1. User-Friendly Interface: Its simplicity suits traders of all levels, especially beginners.

2. Profitability: Many users find consistent profits due to robust algorithms.

3. Versatility: It trades multiple pairs and timeframes, adapting to various market conditions.

4. Customization: Users can adjust settings to match their risk tolerance.

5. Community: A supportive user base shares insights and strategies, fostering learning.

Cons

1. Lack of Transparency: Specific strategies aren’t openly disclosed.

2. Cost: The full version’s price might deter some traders.

3. Market Dependency: Performance fluctuates with market conditions.

4. Technical Issues: Glitches or compatibility problems may disrupt trading.

5. Limited Support: Official customer support might be lacking, affecting assistance availability.

3. Coinrule – Best Automated Crypto Trading Platform

Coinrule provides users with the capability to automate trading strategies across a multitude of cryptocurrency exchanges, granting them the power to streamline their trading processes. With a user-friendly interface, Coinrule offers accessibility and convenience, coupled with customization options and robust security features. Despite its advantages, users must exercise caution and awareness regarding potential limitations and risks associated with Coinrule, such as asset coverage constraints, various pricing models, and the inherent volatility of the cryptocurrency market.

Pros

1. User-Friendly Interface: Novice and experienced traders can create automated strategies without coding.

2. Customization: Users adjust rules to match preferences, risk tolerance, and market conditions.

3. Multi-Exchange Support: It works across multiple cryptocurrency exchanges, diversifying portfolios and leveraging arbitrage.

4. Backtesting: Historical data testing ensures strategy effectiveness before live deployment.

5. Security: Robust measures like 2FA and encryption prioritize user funds and data protection.

Cons

1. Limited Asset Coverage: Coinrule’s asset selection might be narrower compared to rivals, constraining trading possibilities.

2. Subscription Pricing: Varied features across tiers could deter users accustomed to alternative fee models.

3. Internet Reliance: Stable online connectivity is vital for uninterrupted trading due to its cloud-based operation.

4. Learning Curve: Novices may require time to grasp the platform’s functionalities fully.

5. Market Volatility Risks: Coinrule is susceptible to market fluctuations, risking losses if strategies fail to adjust accordingly.

4. EA Builder – Best Expert Advisor for MT5

EA Builder is a platform enabling users to design custom trading robots (Expert Advisors) for MetaTrader without coding skills. It offers a user-friendly solution for creating tailored Expert Advisors, but users should consider potential limitations and risks like complexity, platform reliance, pricing, learning curve, and market uncertainties. While accessible, users should assess these factors before utilizing EA Builder for their automated trading strategies on the MetaTrader platform.

Pros

1. Code-Free Creation: Traders can craft automated strategies without coding knowledge, appealing to all skill levels.

2. Customization: Varied indicators and parameters enable tailored strategies to meet specific trading goals.

3. Backtesting: Historical data testing ensures strategy effectiveness before live implementation.

4. MetaTrader Compatibility: Expert Advisors integrate seamlessly with MetaTrader, a widely used platform.

5. Community Support: An engaged user community shares insights and assistance, aiding learning.

Cons

1. Complexity Limitation: Advanced strategies may be constrained by the platform’s capabilities.

2. Platform Dependence: EA Builder restricts usage to MetaTrader, limiting flexibility for users preferring other platforms.

3. Subscription Pricing: Ongoing costs may deter traders from preferring one-time payments or free alternatives.

4. Learning Curve: Proficiency may require time and experimentation, especially for newcomers.

5. Market Risks: Strategies remain vulnerable to market fluctuations, demanding rigorous testing and risk management.

5. Forex Fury – Best Trading Robot for MT4

Forex Fury is a popular automated trading robot designed to facilitate forex trading, particularly for beginners and experienced traders alike. Forex Fury offers a compelling solution for traders seeking automated forex trading with customizable settings and strong performance, although users should be aware of the associated costs and market risks.

Pros

1. User-Friendly Interface: Easy setup and operation.

2. High Performance: Consistent profitability reported by users.

3. Customizable Settings: Tailor trading strategy to preferences.

4. Compatibility: Works with MetaTrader 4 and 5.

5. Responsive Support: Customer queries addressed promptly.

Cons

1. Purchase Cost: The full version comes at a price.

2. Market Dependency: Performance fluctuates with market conditions.

3. Monitoring Needed: Regular performance checks are advised.

4. Limited Transparency: Trading strategies not fully disclosed.

5. Technical Issues: Potential disruptions due to glitches or compatibility problems.

6. ForexVPS – Among the Best Forex Robots with High Execution Speed

ForexVPS provides virtual private server (VPS) hosting services specifically tailored for forex traders who utilize automated trading robots. ForexVPS offers valuable benefits for forex traders seeking low-latency, stable, and secure hosting solutions for their automated trading systems. However, traders should carefully consider the associated costs, technical requirements, platform compatibility, dependency on third-party services, and scalability limitations before committing to VPS hosting.

Pros

1. Low Latency: Servers near brokers’ data centers ensure fast trade execution for high-frequency strategies.

2. Stable Connection: Reliable internet minimizes downtime during critical trading periods.

3. Enhanced Security: Robust measures protect against cyber threats and unauthorized access.

4. 24/7 Uptime: Uninterrupted service allows round-the-clock trading.

5. Dedicated Resources: Consistent performance with dedicated server resources.

Cons

1. Cost: Valuable services come with recurring subscription fees.

2. Technical Expertise: Setup may require proficiency in server administration.

3. Platform Compatibility: Custom software may encounter integration issues.

4. Third-Party Dependency: Reliance on the provider’s reliability and performance.

5. Limited Scalability: Growth may necessitate upgrading or switching hosting solutions.

7. 1000pip Climber System – Best Forex Robot for Beginners

The 1000pip Climber System is a forex trading software designed to assist traders in identifying potential trading opportunities in the foreign exchange market. The 1000pip Climber System offers a user-friendly solution for traders seeking assistance in identifying potential trading opportunities in the forex market. While it provides clear signals, backtesting capabilities, and customer support, users should be aware of its limitations, including dependence on technology, market volatility, subscription-based pricing, limited customization options, and performance variability.

Pros

1. User-Friendly Interface: Easy navigation suitable for traders of all levels.

2. Clear Signals: Generates distinct buy and sell signals aiding entry and exit decisions.

3. Backtesting: Historical data analysis assesses signal performance for informed choices.

4. Versatility: Applicable across various currency pairs and timeframes, enhancing strategy flexibility.

5. Customer Support: Dedicated assistance is available for user queries and issues.

Cons

1. Technology Dependency: Susceptible to glitches affecting performance.

2. Market Volatility: Unable to foresee sudden market changes, potentially leading to losses.

3. Subscription Model: Recurring fees may deter some traders

4. Limited Customization: The proprietary algorithm restricts parameter adjustments.

5. Performance Variability: Effectiveness varies across different market conditions, necessitating thorough testing.

8. GPS Forex Robot – One of the Best AI Forex Trading Bots

The GPS Forex Robot automates forex trading using preset algorithms, providing traders with convenient automated trading through its advanced algorithms and user-friendly interface. However, users must remain cautious of inherent risks, subscription fees, and potential technical glitches. Effective risk management and continuous monitoring are vital to fully exploit the benefits of employing the GPS Forex Robot in their trading strategies.

Pros

1. Algorithmic Trading: Utilizes advanced algorithms for automatic trading, reducing human error and emotions.

2. Backtesting: Allows historical data analysis to evaluate strategy performance before live trading.

3. Diversification: Trades multiple currency pairs, potentially lowering portfolio risk.

4. 24/7 Trading: Operates continuously, seizing opportunities beyond regular trading hours.

5. User-Friendly Interface: Easy setup and customization for traders.

Cons

1. Market Risk: Vulnerable to market volatility and unexpected movements.

2. Historical Data Dependence: Backtesting results may not predict future performance accurately.

3. Subscription Fees: Costs for accessing the software should be considered.

4. Technical Issues: Possible disruptions due to glitches or connectivity problems.

5. Lack of Adaptability: Limited flexibility in adjusting to changing market conditions.

9. Centobot – Top Trading Robot with Low Minimum Deposit

Centobot provides trading robots that automate trades in financial markets using algorithms. While offering accessibility and potential benefits like emotion-free trading, users should consider technical risks, market volatility, reliance on technology, costs, and lack of flexibility. Traders must assess goals, risk tolerance, and understanding before utilizing such platforms.

Pros

1. Accessibility: Catering to users with varied market experience.

2. Automation: Operating continuously without human intervention.

3. Emotion-Free Trading: Eliminating emotional biases from decisions.

4. Backtesting and Optimization: Testing strategies for enhanced performance.

5. Diversification: Spreading risk across multiple assets or strategies.

Cons

1. Technical Risks: Vulnerability to glitches or connectivity issues leading to losses.

2. Market Volatility: Difficulty in adapting to sudden market changes or extreme volatility.

3. Over-Reliance on Technology: Risk of complacency and inadequate monitoring.

4. Cost: Potential subscription fees or commissions impacting profitability.

5. Lack of Flexibility: Limited adaptability to dynamic market conditions or unforeseen events.

10. Forex Trendy – Top Trading Bot with User-Friendly Interface

Forex Trendy Trading Robots have surged in popularity among forex traders, employing algorithms for automated trading to exploit market trends and secure profits. These robots offer 24/7 trading, emotion-free decision-making, and back testing advantages. Yet, drawbacks like over-optimization risks, technical failures, and reliance on stable markets persist. Traders must weigh these factors before adopting automated systems. Combining automated trading with manual oversight may optimize returns while managing risks effectively.

Pros

1. 24/7 Trading: Seizing opportunities even during traders’ downtime.

2. Emotion-Free Trading: Eliminating emotional biases for objective decisions.

3. Back testing and Optimization: Refining strategies using historical data.

4. Speed and Efficiency: Swift execution is crucial in fast-paced markets.

5. Diversification: Trading multiple pairs to spread risk and enhance profits.

Cons

1. Over-Optimization: Relying too heavily on historical data, leading to poor live performance.

2. Technical Failures: Vulnerability to glitches causing missed opportunities or erroneous trades.

3. Lack of Adaptability: Difficulty adjusting to sudden market changes or unforeseen events.

4. High Costs: Upfront and ongoing expenses eating into profits, especially for small accounts.

5. Market Dependency: Struggles during volatile or unusual market conditions, requiring close monitoring.

Future Trends in Forex Trading Robots

1. Integration of Artificial Intelligence (AI) and Machine Learning (ML)

Trend: AI and ML are increasingly being integrated into forex trading robots to enhance their predictive capabilities and adaptability. These technologies allow robots to analyze vast amounts of data, identify patterns, and make more informed trading decisions.

Explanation: AI-powered robots can continuously learn from new data, improving their performance over time. Machine learning algorithms help these robots adapt to changing market conditions and optimize trading strategies without human intervention.

Recommended Reading: Entrepreneurship and Leadership: 6 Major Differences

2. Enhanced Customization and User Control

Trend: Future forex robots will offer greater customization options, allowing traders to fine-tune settings based on their specific strategies and preferences.

Explanation: Advanced robots will provide more granular control over trading parameters, such as risk management settings, trading signals, and strategy adjustments. This will enable traders to tailor the robot’s behavior to align with their individual trading styles.

3. Integration with Blockchain Technology

Trend: Blockchain technology is starting to influence forex trading by improving transparency and security. Forex robots may integrate with blockchain to enhance data integrity and transaction security.

Explanation: Blockchain can provide a decentralized and tamper-proof ledger of trades and transactions, which can help verify and secure the trading process. This can reduce the risk of fraud and improve trust in automated trading systems.

4. Increased Focus on Real-Time Data and Sentiment Analysis

Trend: Future trading robots will leverage real-time data feeds and sentiment analysis to make quicker and more accurate trading decisions.

Explanation: By incorporating real-time news, economic indicators, and social media sentiment, robots can react faster to market-moving events. This will help traders capitalize on short-term opportunities and mitigate risks more effectively.

5. Development of Hybrid Trading Systems

Trend: Hybrid trading systems that combine both manual and automated trading strategies are gaining traction.

Explanation: These systems allow traders to manually intervene or adjust strategies in conjunction with automated trading. This hybrid approach offers the benefits of automation while retaining the flexibility and oversight of manual trading.

6. Advanced Risk Management Features

Trend: Future forex robots will incorporate more sophisticated risk management tools, including adaptive stop-loss mechanisms and dynamic risk assessment.

Explanation: Enhanced risk management features will help traders better manage their exposure to market risks. Robots will use advanced algorithms to adjust stop-loss levels and position sizes based on market volatility and other risk factors.

7. Cloud-Based Trading Platforms

Trend: Cloud technology is becoming more prevalent in forex trading, offering scalability and accessibility.

Explanation: Cloud-based trading platforms allow traders to access their forex robots from anywhere with an internet connection. This enhances flexibility and ensures that robots can operate continuously without relying on local hardware.

8. Greater Emphasis on User Education and Support

Trend: As forex robots become more sophisticated, there will be an increased focus on providing comprehensive educational resources and support to users.

Explanation: Providers will offer detailed tutorials, webinars, and customer support to help traders understand and effectively use advanced forex robots. This support will be crucial for maximizing the benefits of automated trading systems.

| Details Description Chart of the Top Forex Trading Bots | ||||

|---|---|---|---|---|

| Product Info | Operating type | Effectiveness | Price | Capabilities |

| IG | Broker | Performance data is not available. | Variable (Depends on trading conditions) | Wide range of markets, advanced trading platform, regulatory compliant |

| Forex Gump | Robot | Real Accounts: Myfxbook verified results show steady growth. | $199 (one-time purchase) | Suitable for beginners, multiple currency pairs, easy installation |

| Coinrule | Tool | Performance data is not available. | Starts at $29/month | Automated trading rules, no coding required, support various exchanges |

| EA Builder | Tool | Performance data is not available. | Free (with limited features) and paid plans are available | Build custom EAs without coding, backtesting functionality |

| Forex Fury | Robot | Real Accounts: Myfxbook verified results show consistent performance and gains. | $229 - $439 (one-time purchase) | Supports multiple currency pairs, NFA compliant, 24/7 customer support |

| ForexVPS | VPS Service | Performance data is not available. | Starts at $25/month | Low latency, optimized for forex trading, 24/7 technical support |

| 1000pip Climber System | System | Real Accounts: Myfxbook verified results show steady profits | $97 (one-time purchase) | Signals for major currency pairs, user-friendly, email alerts, mobile notifications |

| GPS Forex Robot | Robot | Real Accounts: Myfxbook verified results show consistent gains. | $149 (one-time purchase) | 24/7 trading, user-friendly, 60-day money-back guarantee |

| Centobot | Robot | Performance data is not available. | Free (with limited features) and paid plans are available | Automated trading for cryptocurrencies, user-friendly interface |

| Forex Trendy | Tool | Performance data is not available. | $37/quarter (subscription) | Trend analysis, customizable settings, live charts |

Conclusion

Today, a plethora of forex robots cater to various trading needs, from beginners to experts. These robots leverage cutting-edge technology to seek profitable trades. Novices can operate them with predefined settings via a start/stop button, while experienced traders can adjust settings for riskier strategies. It’s crucial to align the chosen robot with your preferred trading strategy for optimal results, whether it’s hedge trading or news-based strategies. Investing in the right forex robot can simplify trading for those lacking experience or time.

Moonpreneur is on a mission to disrupt traditional education and future-proof the next generation with holistic learning solutions. Its Innovator Program is building tomorrow’s workforce by training students in AI/ML, Robotics, Coding, IoT, and Apps, enabling entrepreneurship through experiential learning.