Moonpreneur

Enrolling in summer courses can help you progress in your academic field of study. If you take summer classes, you can complete your degree in less time by completing your program all year round instead of taking a long summer break. Unfortunately, obtaining financial aid for summer courses is sometimes tricky.

What Is FAFSA?

Put, FAFSA, or Free Application for Federal Student Aid, is the official form to avail government financial aid to cover college costs. It is also used by several states, specific colleges, and universities when deciding who will receive financial help.

The FAFSA explicitly uses the data gathered from the application to decide who will receive aid through loans, scholarships, and grants. All courses you attend during the academic year, including any summer courses, should be covered by your FAFSA application if you have submitted one to be eligible for the fall or spring semester aid.

Take The First Step — Check Deadlines and Requirements

The first step is understanding how your institution groups summer courses into the academic year. For instance, if you want to enroll in classes this summer, it’s feasible that they will fall under either the 2022–2023 or the 2023–2024 academic years. So, it is always advisable to inquire about the FAFSA requirements for each summer program from the financial aid office at your institution.

Check out our blog for information, instructions, and deadlines if you need to resubmit your FAFSA!!

How to Apply for the FAFSA?

The FAFSA can appear complicated, but following the instructions below should only take an hour to get it done!!

1. Gather the necessary data

When completing the FAFSA form, you must provide the necessary information. You can expedite the procedure with all the required documents and information.

- Please enter your Social Security Number

- Mention the size and income of your family

- Mention any personal income you may have

- Your list of schools to which you are applying

2. Make an (FSA) ID or Federal Student Aid ID

Once you have your supporting documentation, you must know where to submit your FAFSA application. The following step is to create an FSA ID if you’re presenting your FAFSA online or using a mobile application. Each year you enroll in college, this code is utilized to complete the FAFSA.

It may be made online and takes around 10 minutes to complete. Each student has a distinct FSA ID. Your FSA ID and your child’s FSA ID will be different if you’re a parent.

3. Complete the Student Information form

You can start filling out the FAFSA online or through the app after you receive your FSA ID. Pick the form you want to fill out, probably for the following school year, and start with the student demographics. Information about you, including your name, age, and birthdate, will be requested there.

You’ll also be asked to enter the colleges you are considering applying to. Enter every school you’re considering to ensure you obtain the maximum financial aid from each.

You’ll also be asked questions in the dependence section to assess whether you qualify for financial aid as a dependent of your parents.

4. Add the parent’s details

After finishing the student part, you must submit your parents’ information. You must fill out this area even if you don’t have a dependent or live with your parents. You must complete the form with their names, mailing addresses, and other pertinent data.

5. Offer Your Financial Details

The financial information for your household, including your income and those of your parents, must then be entered. You can utilize the IRS Data Retrieval Tool to automatically retrieve the relevant information from your tax return when submitting a FAFSA application online.

6. Go over your FAFSA

Make careful to check your FAFSA application for errors or inaccuracies before submitting it. Verify your financial details and the list of schools you entered once more.

7. Fill out your FAFSA form and sign it

You can electronically sign the form and submit it once you know all the information is accurate. It’s all over; you’re done.

Have all of your federal financial aid options been exhausted?

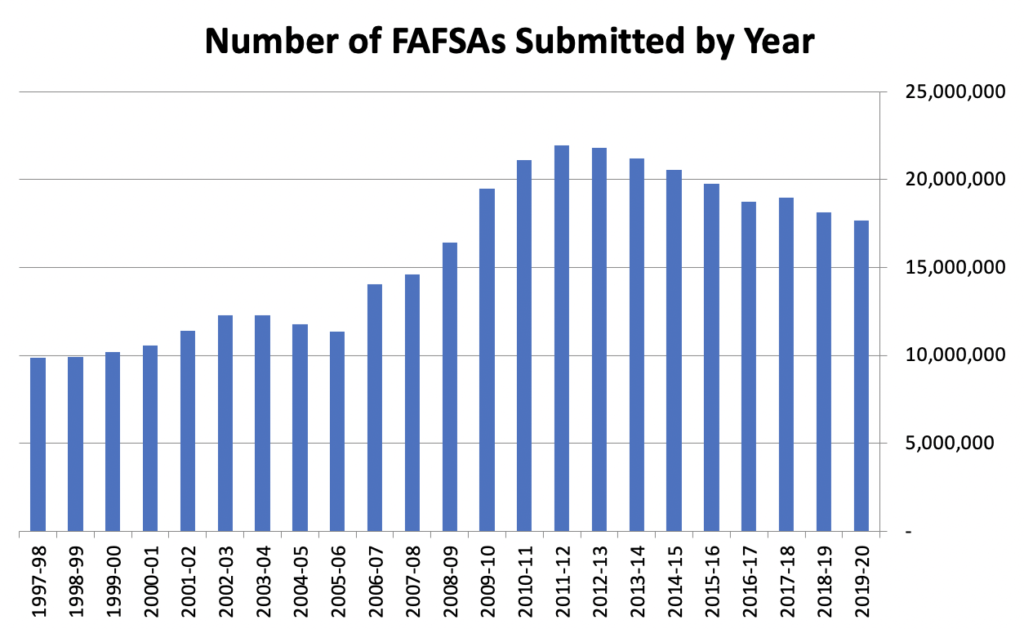

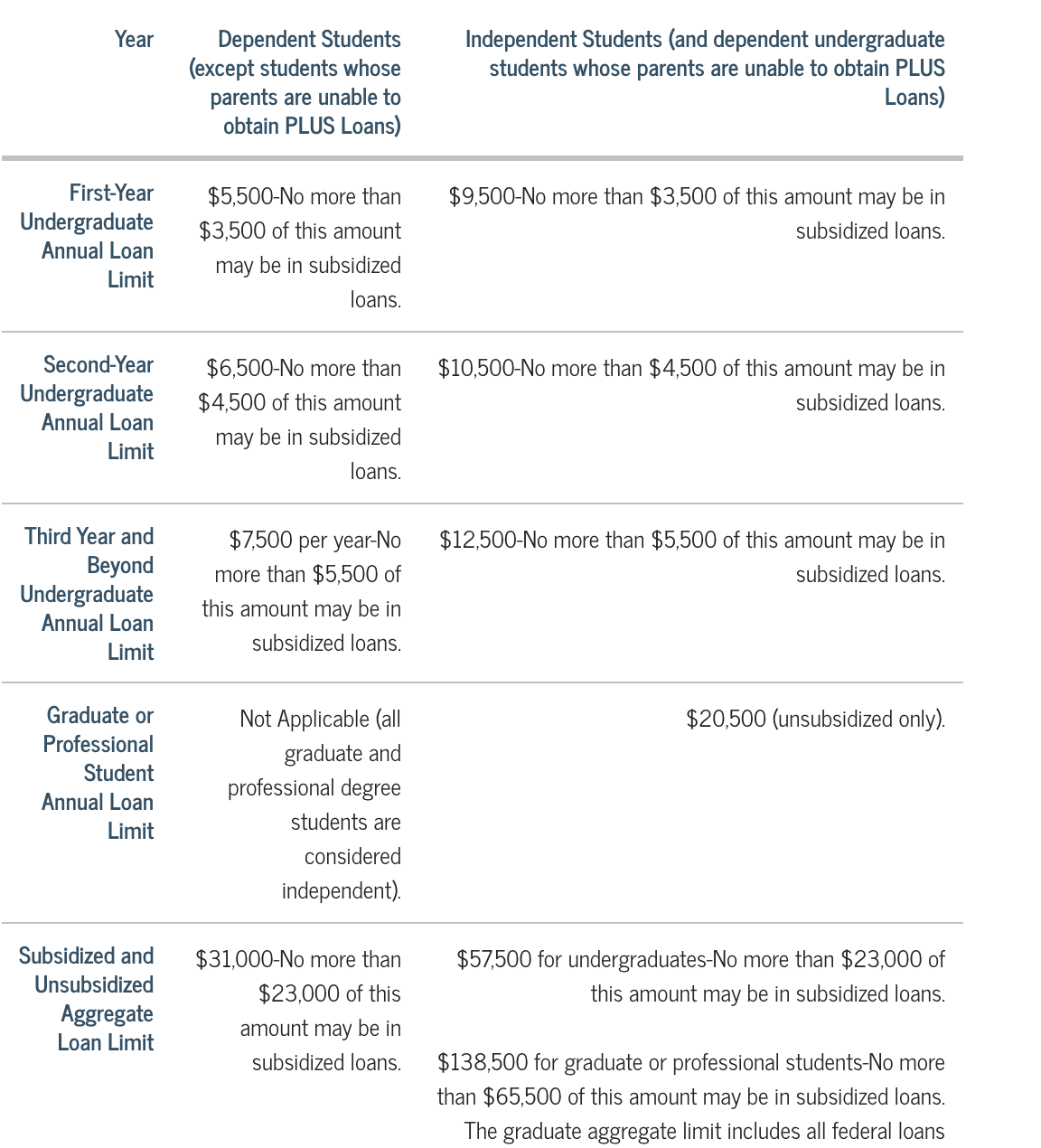

Although the FAFSA can be used to pay for summer classes, and submitting it can increase your chances of receiving financial aid, you should be aware that the total amount of federal student loans you are entitled to borrow each year is subject to a cap. And summer classes are included in these restrictions.

The maximum number of federal student loans you are eligible for each academic year is listed in the table below. You won’t be able to obtain these loans for your summer semester if you spend all your permitted funds on your autumn and spring semesters.

So, it is always advisable to check!!

A FEW KEY POINTERS

- The federal government uses the Free Application for Federal Student Aid (FAFSA) to determine if a family is eligible for grants, work-study, and loans to pay for college.

- The FAFSA data is also used by states, specific colleges and institutions, and private scholarship programs to make financial aid choices.

- The FAFSA application period begins in October of the year before enrollment and ends in June of the following school year.

- Students who apply in June are often only eligible for loans, with funding frequently distributed on a first-come, first-served basis.

Moonpreneur is dedicated to transforming conventional education, preparing the next generation with comprehensive learning experiences. Our Innovator Program equips students with vital skills in AI/ML, Robotics, Coding, Game Development, and App Development, fostering entrepreneurship through hands-on learning. This initiative aims to cultivate the workforce of tomorrow by integrating innovative technologies and practical skills in school curriculums.

Register for a 60-minute free workshop today!