Paying private school tuition out of pocket can strain any family budget. But if your child is zoned for a “failing” public school in Alabama, you might be able to get some of that money back.

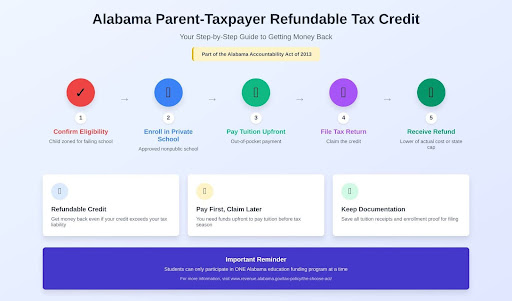

The Parent-Taxpayer Refundable Tax Credit, part of the Alabama Accountability Act of 2013, lets you claim a credit on your state income taxes to help offset tuition and fees at an approved nonpublic school.

Here’s How It Works

Step 1: Confirm your child is zoned for a public school classified as “failing”.

Step 2: Enroll them in an approved nonpublic (private) school and pay tuition and fees out of pocket.

Step 3: When you file your Alabama state income tax return, claim the credit.

Step 4: Receive a refund based on the lower of two amounts: what you actually paid or the annual cap set by the state.

What Makes This Different?

Unlike Alabama’s CHOOSE Act ESA, this isn’t upfront funding. You’ll need to have the money available to pay tuition first, then wait until tax season to get reimbursed.

You can also claim this credit for mandatory fees if your student transfers to a non-failing public school.

Why Consider This Option?

If you’re already planning to move your child out of a failing school, this credit can make a significant difference when tax time rolls around. It won’t cover costs immediately, but it helps recover what you’ve already spent.

And because it’s refundable, you can receive money back even if your credit exceeds your tax liability.

Planning Ahead

Since you pay first and claim later, budget accordingly. Keep all tuition receipts and documentation from your child’s private school. You’ll need proof of payment and enrollment when filing.

Remember: students can only participate in one Alabama education funding program at a time. If you’re considering the CHOOSE Act ESA or the Alabama Education Scholarship Program, compare timing and amounts before committing.

For More Information: Review the full Alabama Accountability Act details or contact ClassWallet at help@classwallet.com or 877-969-5536 (Monday-Friday 7am-7pm CT, Saturday 9am-3pm CT).

Moonpreneur is on a mission to disrupt traditional education and future-proof the next generation with holistic learning solutions. Its Innovator Program is building tomorrow’s workforce by training students in AI/ML, Robotics, Coding, IoT, and Apps, enabling entrepreneurship through experiential learning.